REER (Real Effective Exchange Rate) is widely misconstrued in Pakistan as a measure of relative undervaluation or overvaluation of currency. More importantly, it is not a leading but a lagging indicator of a currency’s valuation relative to its peer trading partners’ currencies.

What is REER? SBP explains the concept as ‘100 should not be misinterpreted as denoting the equilibrium value of the currency. 100 merely represents the value of the currency at a chosen point in time (in this case the average value of the currency in 2010). Therefore, movement of the REER away from 100 simply reflects changes relative to its average value in 2010 and is unrelated to its equilibrium value.’

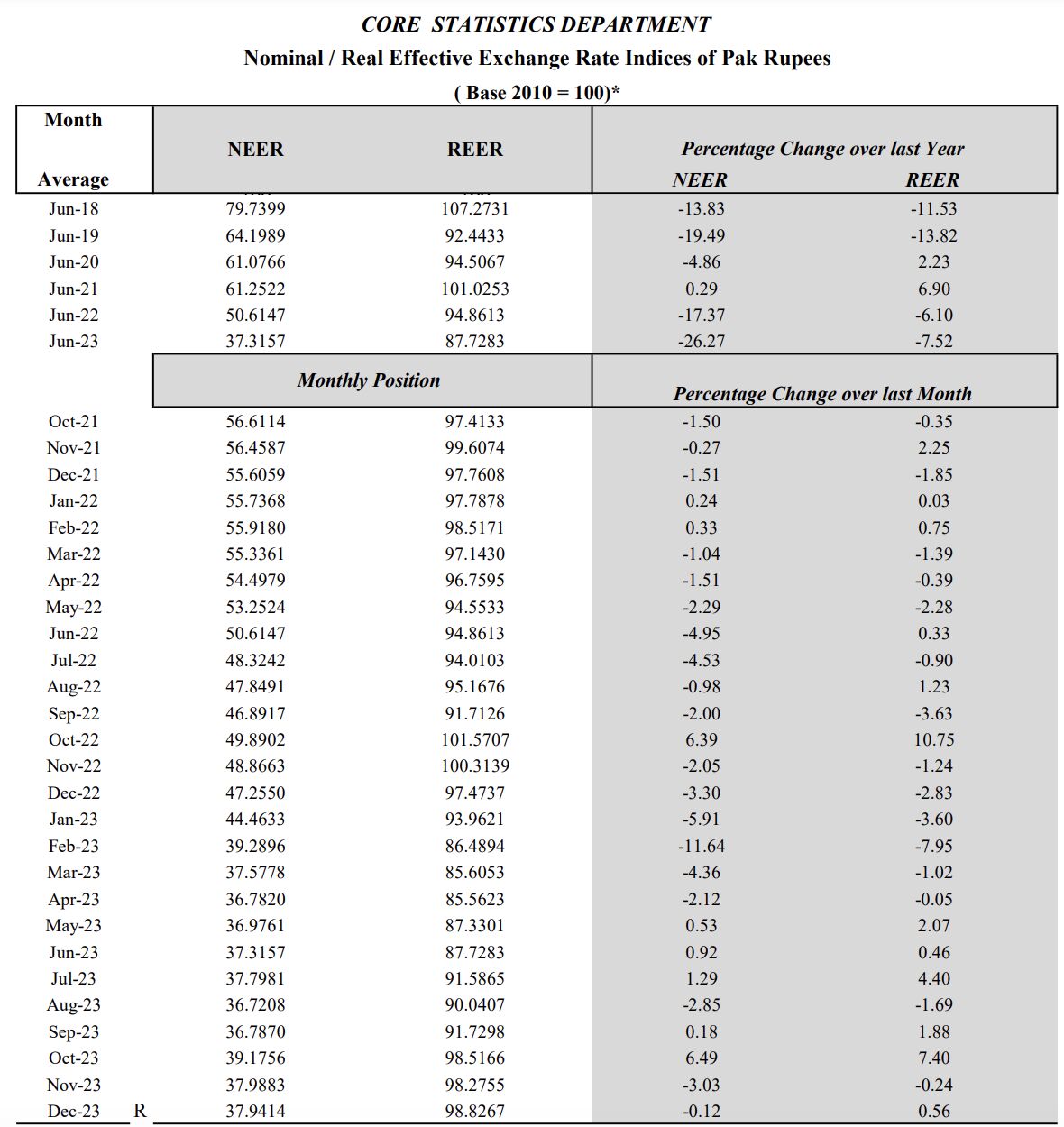

A year ago, REER had dropped to 85 in Mar/23 when PKR had depreciated sharply to 280ish against the USD, triggering expectations of currency appreciation. There is general understanding that a REER of 100 means a currency in equilibrium; hence, REER of 85 was misunderstood as implying 15% currency undervaluation.

In Dec/23, while PKR was still 280ish versus the USD, the REER had risen to almost 99. REER is calculated using an inflation differential between the home and basket currencies. The resulting hyperinflation from the last currency devaluation widened the gap between the two currencies, thereby increasing REER back to 99 by Dec/23.

On a separate note, REER is also a relatively theoretical measure. Practically speaking, market demand and supply (current + financial account) determine the equilibrium level of a currency.