The government has finalized Budget 2025 and continued with the policy of burdening the burdened. While additional taxes were anticipated in the wake of a new IMF program, it is surprising to see the level of additional burden on existing taxpayers. I can certainly call it the most insane budget, at least in my career.

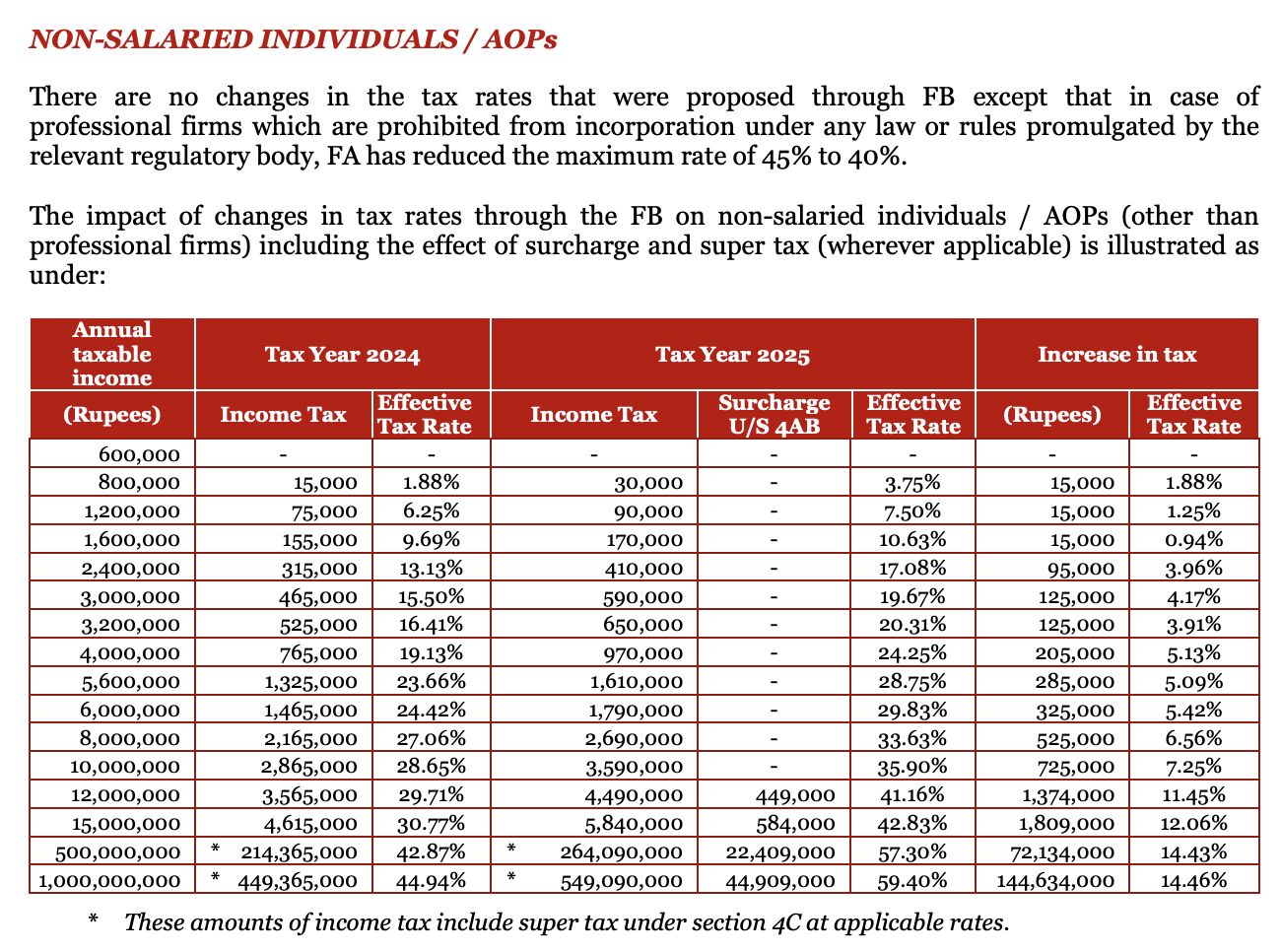

Taxes for the salaried class have been increased further. Effective taxation on AOPs earning above PKR 500 million has reached 57%; even developed nations do not charge that much despite offering way more in return.

Private sector is the backbone of any economy and is the source of sustainable growth. Such taxation shall not only encourage tax evasion by existing players but also discourage smaller ones to grow in size, thereby proving to be the biggest hurdle to economic growth in ensuing years. Unfortunately, the incompetent policy makers lack any understanding of this.

At the same time, some sectors and elite continue to enjoy exemptions. What is even more concerning is what comes next. With this mindset, there will be even more burden in the Budget 2026; we cannot rule out a mini-budget 2025 either.

Nevertheless, brain drain shall only accelerate from here onwards. Those who can leave will leave the country in search of better life and opportunities. However, those who do not want to leave or cannot leave for any reason must start looking for secondary incomes now. With dismally low rental yields, I believe their savings can do much better with capital markets.